<">

<">

10.1 Ordinary Income

This chapter contains the following sections:

In this chapter

This chapter contains the following section:

Note: Sections 4 and 5 have been developed as a priority. Other procedures relating to Ordinary Income will be provided later.

<">

10.1.4 Income from Employment

Last amended: 5 September 2011

This section contains procedures for the assessment of income from employment (earnings).

In this section

This section contains the following topics:

See Also

Income

<">Chapter 9.1 Income and Asset Test Principles

<">Chapter 9.11 Compensation Recovery

<">Chapter 10.1 Ordinary Income

<">Chapter 11.1 Income Support Effective Dates and Pension Periods

<">Chapter 12.1 Recipient Obligations

<">Chapter 12.2 Information Gathering Powers

<">Chapter 12.3 Data Matching

<">Chapter 12.6 Overpayments

<">Chapter 12.7 Specific and Compliance Reviews

Policy information about income from employment can be found in the CLIK Policy Library.

Policy Library – Income from employment

<">

Assessment of Income from Employment

Last amended: 5 September 2011

Specific reviews of earnings

Recipient Obligations

Section 54 VEA

Review pensioners with employment income according to the <">specific review guidelines.

Procedure Library – Earnings reviews

Policy Library – Earnings reviews

10.1.4/Specific (Periodic) Reviews

Policy Library – Date of effect

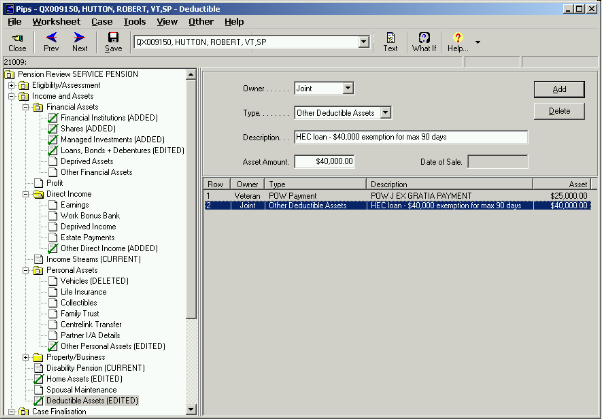

Employment income is recorded in the Earnings screen in PIPS.

What is employment income

Employment income is income earned, received or derived from remunerative work as an employer/employee relationship. This may include wages, salary, honorarium, commissions and fringe benefits earned by an employee.

Policy Library – Meaning of “employment income”

The following types of income are not considered to be employment income for the work bonus :

- Business income

More →More → (go back)

Policy Library – Meaning of “employment income”

- Self employment – sole traders

More →More → (go back)

Policy Library – Meaning of “employment income”

- Director's fees – where the person has an involvement in the company

More →More → (go back)

Policy Library – Director's fees are generally excluded

Policy Library – Allowed director's fees

- Royalty payments

More →More → (go back)

Policy Library – Royalty payments

- Workers compensation, salary continuance and income protection payments.

More →More → (go back)

Policy Library – Amounts not employment income

Policy Library – Overview of Compensation Recovery

Policy Library – Income from Personal Injury Schemes

Annual rate of income converted to fortnightly figure for PIPS

For the purposes of applying the <">income test, the policy refers to calculating an annual rate of income. When recording income from employment in the pension assessment via <">[glossary:PIPS:], convert the annual rate of income to a fortnightly figure.

Policy Library – Definition of annual rate of income

Procedure Library – How to convert income for PIPS

Reviewing a pensioner notification of income from employment

The six steps below summarise the process for assessing income from employment.

|

Step |

Action |

|

1 |

When notification received that a pensioner or their partner has commenced or changed employment, request verification of employment income, including salary sacrifice and details, eg part time, hours worked, employer details, if not already provided. More →

Procedure Library – Evidence of income earned |

|

2 |

Decide whether the earnings will be/continue to be regular, variable or one-off. More →

Procedure Library – Types of employment income 10.1.4/Establishing if Employment is Regular, Variable, or One-off |

|

3 |

Calculate the annual rate, which reflects the income, expected for next 12 months. More →

Procedure Library –Regular income 10.1.4/Calculating Income – Regular Earnings Procedure Library – Variable income 10.1.4/Calculating Income – Variable Earnings Procedure Library – One-off income Policy Library – Definition of annual rate of income

This may be:

|

|

4 |

Set up a review cycle in <">[glossary:DRS:] using the date for the end of the review cycle: More →

Departmental Review System – DRS User Guide Procedure Library – Earnings reviews Chapter 12.7 Specific and Compliance reviews Procedure Library - Variable earnings review cycle

|

|

5 |

Convert annual rate of income to a fortnightly rate and record via <">[glossary:PIPS:]. More →

Procedure Library – Date of Effect and Obligations for Earnings Reviews 10.1.4/Date of Ef — fect and Obligations for Earnings Reviews |

|

6 |

Advise pensioner in <">[glossary:PIPS:] advice text of:

Note: Even though the income appears in 'Income and Assets' list of the PIPS advice, it is repeated at the beginning of the advice, with specific instructions for the next review period. |

<">

Invalidity, Income Protection Insurance, Salary Sacrifice, Fringe Benefits and Purchased Leave

Invalidity service pension or ISS and earnings

If a <">veteran, (not their partner) or <">war widow/widower, who has been granted <">[glossary:service pension:] or <">[glossary:ISS:] of the grounds of <">[glossary:permanent incapacity:] advises that they have commenced employment, investigate their continuing eligibility to an <">income support pension on the grounds of invalidity. Examine the nature of their employment, duration and the number of hours worked per week and consider whether they continue to be permanently incapacitated under the eligibility criteria. Earnings of the partner continue to be assessable as <">ordinary income.

Policy Library – Assessment of permanent incapacity and VVRS

Income protection insurance

Personal income protection insurance policies are designed to provide regular income, in the event of inability to work through illness or injury. Gross payments from an income protection policy are usually paid on a monthly or periodic basis and may be regarded as either <">compensation or <">ordinary income under <">section 5NB VEA, depending on whether a <">[glossary:CAP:] is being paid and the specific terms of the policy. Do not deduct the cost of premiums as an expense from a person's ordinary income. Unlike salary continuance schemes, which are purchased through the employer, the person purchases these policies, directly from the insurance provider.

Policy Library - Definition of life insurance policies

10.2.4/Assessing Life Insurance Policies

Policy Library - Income protection treated as compensation

10.1.7/Income from Personal Injury Schemes

Policy Library – Income protection sickness/accident policy treated as compensation

Salary continuance payments

Salary continuance payments are a form of insurance where the employer pays the insurance premium on a person's behalf, as part of a salary package, or the employee purchases the policy from the employer. Unlike income protection insurance, where the person purchases the policies, directly from the insurance provider, salary continuance arrangements are between the person and their employer.

Policy Library – Assessment of salary continuance payments

Salary sacrifice impact on the calculation of annual rate

Include the cash value of salary sacrifice when calculating the annual rate of income. Amounts in respect of salary sacrifice will not usually be evident on pay-slips, you will need to ask the question whether there has been any salary sacrifice. If the value of salary sacrifice has not been included in the annual rate of income calculated, add the figure to the regular salary to obtain the annual rate of income. Note: Treatment of salary sacrifice is different for age pensioners.

Policy Library – Salary sacrifice is assessed as income

Guide to Social Security Law –Deferred Income, Salary Sacrifice, Valuable Consideration & Fringe Benefits

http://www.fahcsia.gov.au/guides_acts/ssg/ssguide-4/ssguide-4.3/ssguide-4.3.3/ssguide-4.3.3.60.html

Salary sacrifice benefits

The following are examples of benefits, which can be received in exchange for salary:

- school fees

- parking

- vehicle and expenses

- superannuation

- fringe benefits

- accommodation, mortgage repayments

- health insurance premiums

- membership fees for professional associations

- education expenses

Fringe benefits assessment

Fringe benefits are made by employers to employees in connection with their employment. They represent valuable consideration and therefore are considered to be <">ordinary income for <">income support purposes. The assessment of income in respect of fringe benefits for DVA income support payments is the same formula as used for age pensioners.

Guide to Social Security Law –Deferred Income, Salary Sacrifice, Valuable Consideration & Fringe Benefits

http://www.fahcsia.gov.au/guides_acts/ssg/ssguide-4/ssguide-4.3/ssguide-4.3.3/ssguide-4.3.3.60.html

Fringe benefits examples

The following are examples of fringe benefits provided by employers in lieu of salary:

- cars

- loans

- expense payments

- housing

- debt waiver

- living away from home allowances

- airline transport

- meals and entertainment

- car parking

Purchased leave and impact on the annual rate

Do not include the value of purchased leave when calculating the annual rate of income.

Policy Library – Salary sacrifice for purchased leave is exempt

<">

Verification of Income

Requesting evidence of income from employment

Request evidence of income, as applicable, from the following options:

Policy Library – Gross amount and salary sacrifice is assessed as income

10.1.4/Asse — ssment of Salary Sacrifice Amounts

Policy Library – Review period and supporting documentation

- pay slips, including details of any allowances paid

- payment summaries, including details of any allowances paid, or fringe benefits provided

- employment contract, including details of salary sacrifice, allowances or fringe benefits provided

What information is required in the evidence

The evidence should provide sufficient information to enable the calculation of an annual rate of income. Check that, where applicable, details of the following are confirmed:

Policy Library – Gross amount, salary sacrifice and allowances

Policy Library – Review period and supporting documentation

- gross annual salary, before any salary sacrifice

- details of fringe benefits provided

- value of any salary sacrifice which has been made, if not included in gross annual salary

- the dates of employment represented by the earnings

- the types, amounts and frequency of allowances paid (the type is needed in order to decide if it is or is not included in the assessment of income)

- hourly rate, details of overtime, number of hours worked

Request evidence of salary sacrifice

Where there has been salary sacrifice, request a letter from the employer/s stating the total gross amount, including allowances and details of the amount and type of salary sacrifice made. Contact the person's employer directly to request information as the employer is not lawfully required to provide a letter to the pensioner. The employer is required to respond to any lawful request made by the department for information. Letters are available for this purpose in DRS.

Departmental Review System – DRS User Guide

Policy Library – Power to request information

Policy Library – Gross amount and salary sacrifice is assessed as income

Request evidence of fringe benefits

Where the employer has provided the person with fringe benefits in connection with their employment, request their payment summaries. Pay slips do not provide details of fringe benefits provided.

<">

Work Bonus

Last amended: 5 September 2011

Work Bonus

Where a person has reached qualifying age and they receive employment income arising from remunerative work undertaken as an employee in an employer/employee relationship, an income test concession (known as Work Bonus) applies.

Policy Library – Income test concession applies to employment income

Under this income test concession, all of the first $250 of the person's fortnightly employment income is disregarded from the income test.

Policy Library – Income test concession examples

Any unused Work Bonus income concession (where employment income is under $250 per fortnight) will accrue to a Work bonus Bank up to a limit of $6,500.

To ensure the correct application of the work bonus, only employment income should be recorded on the PIPS Earnings screen.

Definition of employment income

Employment income for the purpose of the Work Bonus is defined as income from remunerative work earned as an employee in an employer/employee relationship. This may include wages, salary, commissions and fringe benefits earned by an employee.

It is important that only income that meets this definition is recorded in the PIPS Earnings screen. This will ensure that only eligible employment income attracts the Work Bonus income concession and Work Bonus Bank records are correctly maintained.

Business income is not employment income

Profits, and any other income earned by a business, are not employment income for purposes of the Work Bonus. Pensioners involved in a business have the advantage of being able to offset expenses against their gross income for pension income test purposes, an advantage not available to wage or salary earners.

Income related to a pensioner's business is only “employment income” if it is paid by the business to the individual pensioner in the form of a wage or salary. To satisfy this requirement it must be shown as an Expense (salary or wages) on the business profit and loss statement and as “Salary or Wages” or “Allowances, Earnings, Tips etc” on the individual's income tax return.

Self employment – sole traders

Self employed pensioners are operating a sole trader business and do not receive employment income for Work Bonus purposes. The income and assets of a sole trader business should be assessed on the basis of annual income tax returns and recorded in the PIPS Business screen.

Where an individual's employment situation is unclear (ie they don't receive PAYG pay slips or Payment Summaries indicating they are in employment), the deciding factor in whether an individual is considered to be receiving employment income or is self employed, is how income is declared on the individual's income tax return:

- Employment income would be recorded at its gross value in the Income section at the beginning of the tax return, under “Salary or wages” or “Allowances, earnings, tips etc”.

- Sole trader business income is recorded in the Supplementary section which allows for deduction of related expenses from gross income. The net income figure is transferred from the Supplementary section into the Income section of the individual's income tax return.

Where an individual does not lodge income tax returns and their employment situation is unclear:

- If the gross income from employment is assessed for pension purposes, the pensioner should be considered to receive employment income for Work Bonus purposes, and recorded on the PIPS Earnings screen

- If expenses are deducted from income received and net income assessed for pension purposes, the person is a sole trader and their income should be recorded on the PIPS Business screen and not attract the Work Bonus.

Directors Fees

Whether Directors fees received by company directors are considered employment income will depend on the relationship of the pensioner receiving the directors fees to the company which is paying the fees.

A person receiving directors fees who has an involvement in the company which is paying the fees is unlikely to be engaging in remunerative work in an employer / employee relationship with the company. They are therefore considered not to be receiving employment income for Work Bonus purposes.

Where the person receiving directors fees has no involvement in the company which is paying them the fees, they are likely to be engaging in remunerative work in an employer /employee relationship with the company. They are therefore considered to be receiving employment income for Work Bonus purposes.

As set out above, wages and salaries paid by a business to a person will be considered employment income.

Other employment income types

- Honorarium

An honorarium is an honorary reward for voluntary services or a fee for professional services voluntarily rendered. This income is considered to meet the definition of employment income. Although there would presumably be no employment contract, there are two parties in the arrangement who can clearly be identified as the employer and employee. Although the work may not have been done in the expectation of being paid, remuneration was received for the work.

Other employment related income that is not Employment Income

The following types of income, which may be employment related, are not employment income for Work Bonus purposes:

- Workers' compensation, income protection or salary continuance payments

These types of payments are specifically excluded from the definition of employment income and in no circumstances should be recorded in the PIPS Earnings screen. Periodic compensation payments received by age pensioners, service pensioners under pension age or ISS recipients under qualifying age may be subject to the compensation recovery provisions. Periodic compensation payments that are assessed as ordinary income should be recorded in the PIPS Other Direct Income screen. - Royalties

Royalties are not earned as part of an employer / employee relationship and cannot be regarded as employment income. Royalties received by an individual who does not operate a business should be assessed as an amount taken to be received over 12 months and recorded in the PIPS Other Direct Income screen. Royalties received by a business are part of the business income. - Termination payment

A lump sum termination payment made to a former employee on termination is not employment income for Work Bonus purposes. Where assessed as income, such a payment should be recorded in the PIPS Other Direct Income screen. - Leave payments to persons no longer involved in remunerative work

Where a person has ceased working for an employer, but is continuing to be paid outstanding leave entitlements leading up to cessation of employment, they are not receiving employment income for Work Bonus purposes. Leave payments received by persons who are not returning to remunerative work with the employer should be recorded in the PIPS Other Direct Income screen.

<">

Work Bonus Bank

Last amended: 5 September 2011

Assessed employment income for Work Bonus eligible pensioners

Following the introduction of the Work Bonus changes from 28 June 2011, Work Bonus eligible pensioners will have the following advantages in the assessment of their employment income.

- All employment income up to $250.00 per fortnight will be disregarded.

- Where a pensioner:

- Has accrued a balance in their Work Bonus Bank; and

- Employment income increases to, or commences at, over $250.00 per fortnight

All employment income above $250.00 per fortnight will be offset by the available Work Bonus Bank balance and disregarded until the Work Bonus Bank balance runs out.

Work Bonus Bank Accrual

Income Support pensioners eligible for the Work Bonus will be able to accrue their unused Work Bonus income concession to a Work Bonus Bank.

Policy Library – Work Bonus Bank

Amounts will accrue to the Work Bonus Bank as follows.

|

If employment income is ... |

Work Bonus Bank accrues at ... |

|

Nil |

$250.00 per fortnight |

|

Less than $250.00 per fortnight |

$250.00 minus gross rate of employment income received eg if employment income is $200.00 per fortnight – Work Bonus Bank accrues at $50.00 per fortnight |

|

$250.00 per fortnight or greater |

no Work Bonus Bank accrual |

Work Bonus Bank depletion

The Work Bonus Bank balance accrued will be used to offset employment income over $250.00 per fortnight when employment income:

- commences at greater than $250.00 per fortnight

- increases to greater than $250.00 per fortnight

Employment income over $250.00 per fortnight will be offset by any available Work Bonus Bank balance and disregarded under the income test. The Work Bonus Bank balance will deplete as it is used to offset employment income over $250.00 per fortnight. This process will continue until the balance is completely used up.

As a result, if a pensioner has a balance in their Work Bonus Bank, and their employment income increases to above $250.00 per fortnight , or commences at above $250.00 per fortnight, no employment income will be assessed under the income test until the Work Bonus Bank is depleted to nil.

Policy Library – Work Bonus Bank depletion

Example 1 – Commence employment

A pensioner who is eligible for the Work Bonus and is not receiving employment income accrues the full Work Bonus income concession to their Work Bonus Bank at $250.00 per fortnight. The pensioner commences employment more than 12 months after the commencement of accrual, having accrued the maximum balance of $6,500.00.

15 July 2012

- Work Bonus Bank balance $6,500.00

- Commence Employment Income at $2,000.00 per fortnight

From15 July 2012, all employment income is disregarded under the income test. The first $250.00 per fortnight is disregarded due to the ongoing fortnightly Work Bonus discount and the remaining $1,750.00 per fortnight is offset by the Work Bonus Bank balance.

Gross Income $2000.00

Less Work Bonus Discount$ 250.00

Less Work Bonus Bank depletion $1,750.00 $2000.00

Assessed Employment Income — NIL

The above assessment of employment income will continue until the Work Bonus Bank balance is fully depleted on 5 September 2012 (about 3.7 fortnights at a rate of $1750.00 per fortnight). When the Work Bonus Bank balance is fully depleted, employment income above the ongoing fortnightly Work Bonus discount of $250.00 per fortnight will be assessed under the income test.

Gross Income$2000.00

Less Work Bonus Discount$ 250.00

Less Work Bonus Bank depletionNil$ 250.00

Assessed Employment Income$1,750.00

The pensioner will not suffer any reduction in pension due to the increase in income until 5 September 2012 when the Work Bonus Bank balance is fully depleted.

Example 2 – Increased income

The pensioner is earning employment income of $200.00 per fortnight as of 28 June 2011 and is eligible for the Work Bonus. As their employment income is under $250.00 per fortnight, their entire employment income of $200.00 per fortnight is disregarded and $50 accrues to the Work Bonus Bank each fortnight.

Gross Income$200.00

Less Work Bonus discount$200.00

Assessed Employment Income — Nil

Work Bonus Bank accrual$ 50.00($250.00 – $200.00)

The rate of employment income of $200 per fortnight continues for 10 fortnights, during which time the pensioner accrues a Work Bonus bank balance of $500.00. Employment income then increases to $300.00 per fortnight as of 15 November 2011.

- Work Bonus bank Balance; $500.00

- Employment Income increases from $200.00 per fortnight to $300.00 per fortnight

From 15 November 2011, the first $250.00 of the $300.00 per fortnight employment income will be disregarded due to the ongoing fortnightly Work Bonus discount and the remaining $50.00 per fortnight is offset by the Work Bonus Bank balance.

Gross Income$300.00

Less Work Bonus discount$250.00

Less Work Bonus Bank depletion$ 50.00$300.00

Assessed Employment Income — Nil

The above assessment of employment income will continue until the Work Bonus Bank is fully depleted on 3 April 2012 (10 fortnights at $50.00 per fortnight). Then the employment income above the ongoing fortnightly Work Bonus discount will be assessed under the income test and pension may reduce.

Gross Income$300.00

Less Work Bonus discount$250.00

Less Work Bonus Bank depletion$ 0.00$250.00

Assessed Employment Income$ 50.00

Work Bonus Bank and transitional cases

Although the Work Bonus does not apply in the pension calculation for pensioners paid under the Transitional rules, a Work Bonus Bank will be maintained for Transitional pensioners. Eligible Transitional pensioners will accrue amounts to the Work Bonus Bank if their employment income is under $250.00 per fortnight, and the Work Bonus Bank will be depleted if employment income increases to over $250.00 per fortnight.

Policy Library – Transitional Assessments

This allows the comparative calculations between the Transitional and Non-transitional rates to continue to be carried out, to ascertain whether the pensioner continues to be advantaged by the Transitional rules.

The Work Bonus Bank and related deductions will only be applied to the calculation of the person's pension once they are advantaged by the Non-transitional calculation.

<">

Work Bonus Bank Depletion Processing

Last amended: 5 September 2011

Work Bonus Bank Depletion – Processing

Where an eligible pensioner has accrued a Work Bonus Bank balance and their employment income commences at, or increases to, over $250.00 per fortnight, Their Work Bonus Bank balance will deplete to offset the employment income over $250.00 per fortnight.

This depletion process, and the disregarding of the employment income over $250.00 per fortnight, will be set up by the PIPS Worksheet that inserts or increases the rate of Earnings.

Work Bonus Bank fully depleted by PIPS Worksheet

Where the PIPS Worksheet is retrospective and the Work Bonus Bank depletion process ends on a day up to and including the current pension period ie the Work Bonus Bank balance is depleted to nil and employment income over $250.00 per fortnight is no longer disregarded, the process will be completed by the PIPS Worksheet.

The PIPS Worksheet will update Earnings from the Effective Date of the Worksheet. This will result in nil variation from the Effective Date of the Worksheet due to the Work Bonus Bank balance offsetting earnings above $250.00 per fortnight.

Later assessments will then be created when the Work Bonus Bank balance reduces to nil, to assess Earnings above $250.00 per fortnight and reduce pension if appropriate from the applicable date.

Work Bonus Bank depletion continuing following PIPS Worksheet

Where the Work Bonus Bank balance is not depleted to nil by the PIPS Worksheet, and employment income over $250.00 per fortnight continues to be disregarded after the current pension period, the Fortnightly Batch program will identify when the Work Bonus Bank balance will run out and assess Earnings above $250.00 per fortnight and reduce pension if appropriate from the applicable date.

In cases where a PIPS Worksheet is processed to increase employment income over $250.00 per fortnight, but no pension reduction occurs due to the balance in the Work Bonus Bank continuing to offset employment income in full, a paragraph will be included in the automatic advice notifying the pensioner that:

- income from employment is not currently being taken into account to assess pension under the income test,

- employment income is being offset by the credit in the Work Bonus Bank,

- when the Work Bonus Bank credit is used up, employment income above the fortnightly work bonus discount amount of $250.00 will be assessed under the income test and pension may reduce,

- at your current rate of gross employment, the Work Bonus Bank credit is likely to be used up on [depletion end date],

- if there is any change to the rate of employment income, this will change the date on which the Work Bonus Bank credit will be used up.

Work Bonus Bank fully depleted by PIPS Worksheet

Where a retrospective PIPS case reduces pension due to the commencement or increase of employment income above $250.00 per fortnight, but the reduction is processed by the PIPS case but from a date later than the Worksheet Effective Date due to a Work Bonus Bank balance, the automated advice will provide details of the deferral of the reduction.

Work Bonus Bank depletion end – pension reductions

Where employment income over $250.00 per fortnight is being offset by a balance in the Work Bonus Bank, the person's Work Bonus Bank balance will effectively be depleting at a daily rate equal to:

- (Gross employment income per fortnight minus $250) divided by 14

This daily rate of depletion is unlikely to divide evenly into the Work Bonus Bank balance. This creates a situation where the rate of depletion on the final day of depletion will be smaller, as the residual balance on the final day is smaller than the daily rate of depletion.

Policy Library – Work bonus bank depletion example – complex case

This means that in most cases where the depletion of the Work Bonus Bank ends, the pensioner will receive two pension reductions on successive days:

- the first reduction will occur when the balance in the Work Bonus Bank falls to less than the daily rate of depletion and part of the Earnings over $250.00 per fortnight are assessed

- the second reduction will occur the following day, when the Work Bonus Bank balance is nil and all of the Earnings over $250.00 per fortnight are assessed.

This will be reflected in two pension assessments on consecutive days in the Pension Assessment tab in VIEW.

<">

Establishing if Employment is Regular, Variable, or One-off

No previous pattern of employment has been established

Ask the following questions to assist your determination of whether earnings will be regular, variable or one-off:

Policy Library – Earnings types

- will your/your partner's hours be regular?

- what are the hours expected to be worked per week/fortnight/month?

- is your/your partner's rate of pay regular?

- how much do you expect to earn per week/fortnight/month?

- is employment for a fixed period?

- if employment is for a fixed period, are you/your partner likely to obtain more employment within the next 3/12 months of previous job finishing?

- are there any breaks in employment expected that will be unpaid?

Previous pattern of employment has been established

Ask the following questions to assist your determination of whether the current pattern of earnings will continue to be regular, variable or one-off:

Policy Library – Earnings types

- how long have you/your partner been employed?

- have your/your partner's hours of work been regular or irregular?

- is this likely to continue?

- what was the total gross amount you/your partner earned for the last 3 / 6 / 12 months?

- are your/your partner's hours or pay rate likely to increase or reduce over the next 3 months?

- will there be any breaks in employment that will be unpaid?

How to decide whether earnings are assessed as regular, variable or one-off

Use the information obtained from the questions above to decide whether the pattern of earnings is to be assessed as regular, variable or one-off as follows:

Policy Library – Earnings types

|

If... |

Then assess and review the income as... |

Examples |

|

the hours worked and income do not vary from pay to pay |

regular More →

Procedure Library – Annual rate of income for regular earnings Policy Library – Regular earnings |

a permanent, part-time waiter consistently working 10 hours per week and earning $200 per fortnight |

|

the hours worked and income fluctuate from pay to pay, there is no expectation that work will continue |

variable More →

Procedure Library – Annual rate of income for variable earnings Policy Library – Variable earnings |

casual waiter, on call, penalty rates for weekends, no predictable number of hours worked from week to week, may not work during some periods |

|

the single block of employment is less than 12 months and there is no likelihood of further employment from any source within the next 12 months |

one-off More →

Procedure Library – Annual rate of income for one-off earnings Policy Library – Single period or one-off earnings |

a person whose only employment is 4 weeks as a Santa Claus at Christmas time, or a one-off short contract, such as a fruit picker, or |

Identifying earnings as regular

Assess the following as regular earnings:

Policy Library – Income from regular employment

- full time and contract employees where income from employment does not vary from pay to pay

- part-time or casual work where income from employment is regular and does not vary from pay to pay

Note: If the person's hours or hourly rate start fluctuating, then change from assessing earnings as regular to variable or one-off, depending on their circumstances.

Identifying earnings as variable

Assess earnings that are not predictable from pay to pay as variable earnings:

- contract employees where income may be on a fee for service basis

- persons who have more than one employer and the earnings from at least one employer varies from pay to pay

- part-time or casual employees where hours and income from employment varies from pay to pay

As it may be difficult to forecast what the annual rate of income is going to be, an estimate of earnings will be required initially.

Policy Library – Variable earnings

Identifying earnings as one off

Assess earnings as one-off when there is no likelihood of further employment, from the same or a different source within the next 12 months.

Policy Library – Single period or one-off earnings

When earnings change from variable to regular

A person assessed as having variable earnings, may be assessed as having regular earnings, on a seasonal or predictable basis, for a limited period, (eg an emergency teacher employed for a full school term). In this case, assess as having regular earnings for the period, and revert to a variable assessment at the end of the period. Note: The period should be at least 3 months in duration.

<">

Calculating Income – Regular Earnings

How to calculate the annual rate of income for regular earnings

The annual salary of a person is equivalent to the annual rate of income .If a figure for gross annual salary is not available, convert the gross amount of weekly, fortnightly, or monthly wages into an annual figure to obtain the annual rate of income.

Procedure Library – Annual rate of income is converted to fortnightly figure for PIPS

Policy Library – Definition of annual rate of income

Policy Library – Regular income from employment

Examples of how to convert income for regular earnings for PIPS

For <">[glossary:PIPS:] purposes, convert the annual rate to a fortnightly figure. Examples of the methods of calculating the fortnightly rate of regular earnings income are provided in the following table.

Procedure Library – Annual rate of income is converted to fortnightly figure for PIPS

|

If the income quoted is... |

Then ... |

To obtain the fortnightly figure of income for PIPS... |

|

$120 per week |

multiply weekly wages by 2 |

$240 |

|

$240 per fortnight |

no further calculation required |

|

|

$520 per month |

multiply monthly wages by 12 and divide by 26 |

|

|

total of $1,560 for 3 months work |

multiply the 3 months total by 4 and divide by 26 |

|

|

$6,240 per annum |

divide by 26 |

<">

Calculating Income – Variable Earnings

Variable earnings review cycle

Negotiate with the pensioner to decide on an appropriate review cycle, eg, 13 weekly, 14 weekly, 3 monthly. Establish an interval which will be fair to the pensioner and will be easy to administer and takes into account individual circumstances, such as whether they are paid by calendar month or on a weekly, fortnightly or irregular basis, or whether they have more than one job with different paydays. Advise pensioner with variable earnings of their obligations to notify their earnings for the previous review period within 14 days of the end of the review period or when there is a significant change in the earnings pattern or rates, rather than every time their earnings vary.

Policy Library – Review period

Procedure Library – Examples of suggested free text for PIPS advices

Estimating future variable earnings for new employment

When advice is received that a person has commenced employment and they are unable to predict how many hours they will be working and how much they will earn in a period, calculate an estimate of the fortnightly income and record in the pension assessment for the first 3 months. When estimating earnings the following is to be taken into account:

Policy Library –Definition of annual rate of income

Policy Library – Variable income from employment

- expected breaks in employment

- hourly rate of pay

- penalty rates

- overtime

- irregularity

- known minimum number of hours to be worked

- actual earnings from first two weeks of employment

Example how to calculate an estimate of earnings

Notification is received that veteran's partner has commenced employment as a receptionist, with minimum of 15 hours per week. They are additionally employed on an on-call basis, which may or may not result in extra work. They are paid a fixed rate at $20 per hour. They estimate that they will be working 40 hours per fortnight = $20 x 40 = $800 gross per fortnight. In this case, the earnings will be reviewed at 14 weeks, as the partner is paid fortnightly. At $800 per fortnight, it is expected that $5,600 will be earned over the 14 weeks.

Overview how to calculate income for variable earnings for PIPS

The steps for calculating and applying the fortnightly rate of variable earnings income, based on actual earnings, are provided in the following table.

Procedure Library – Annual rate of income is converted to fortnightly figure for PIPS

Policy Library – Definition of annual rate of income

Policy Library –Variable income from employment

|

Step |

Action |

|

1 |

Following the due date for the end of the review period, add the actual earnings, as confirmed by pay slips etc, for the preceding review period. eg if the review period spans 14 weeks, total the earnings for the full 14 weeks |

|

2 |

Divide the total by the number of weeks represented in the period, eg divide by 14 |

|

3 |

Multiply the result by two to obtain the fortnightly figure for <">[glossary:PIPS:] |

|

4 |

Apply the figure based on the actual earnings for the next review period, eg 14 weeks |

Step 1 - example of when earnings are confirmed

The following table shows the actual earnings, on a fortnightly basis, for the period 31 — st January 2005 to 8 — th May 2005 (14 weeks). Note that there were no earnings for the second and last fortnights.

|

Fortnight |

Gross Earnings |

|

$ 750 |

|

$ nil |

|

$ 850 |

|

$ 700 |

|

$ 700 |

|

$ 780 |

|

$ nil |

|

Total 14 weeks – 31st Jan 2005 to 8th May 2005 |

$ 3,780 |

Step 2 -averaging earnings over the 14 week review period

Follow the two steps below to obtain an average of the variable earnings for a 14 week period of employment.

|

Step |

Action |

|

1 |

Add the earnings, using the example, from weeks 1 to 14 to obtain total = $3, 780 |

|

2 |

Divide total by 7 to obtain the fortnightly rate of income to be recorded in <">[glossary:PIPS:] = $540 |

Converting variable earnings for PIPS according to the review cycle

Examples of the formulae for calculating the fortnightly rate of variable earnings income for <">[glossary:PIPS:], according to the review cycle, are provided in the following table.

Procedure Library – Annual rate of income is converted to fortnightly figure for PIPS

|

If the variable review cycle is... |

Then total the income for the whole period and... |

|

13 weekly |

divide total by 13 and multiply by 2 |

|

14 weekly |

divide total by 7 |

|

3 calendar monthly |

multiply total by 4 and divide by 26 |

Averaging earnings when evidence provided does not match review period

Follow the three steps below to obtain a daily average of the variable earnings, where the period covered by the evidence supplied by the person does not match the review period, eg the person has supplied pay slips from 31 — st January 2005 to 30 — th April 2005 (90 days) and the review period is from 31 — st January 2005 to 8 — th May 2005 (14 weeks).

|

Step |

Action |

|

1 |

Add the earnings for the 90 days to obtain total = $3,780 |

|

2 |

Divide total at $3,780 by 90 to obtain daily income = $42 |

|

3 |

Multiply $42 by 14 to obtain fortnightly rate of income to be recorded in <">[glossary:PIPS:] = $ 588 |

|

4 |

Set the next review period to commences from 1 — st May 2005 for:

|

Revising an estimate of earnings based on actual earnings

As actual earnings for variable income are confirmed up to 14 weeks after they have been earned, rather than every time they vary, it may be necessary to pay arrears of pension if the actual earnings are less than expected. Arrears may be paid at the end of the first review period after a person has newly commenced variable work and has made an estimate which was higher than what the earnings actually were. Arrears may also be paid at subsequent reviews, where the 'estimate' of future earnings was based on the actual earnings for the previous review period and the earnings for the current period, when confirmed, have dropped from previous period.

Policy Library – Review period

Arrears payable for variable earnings

As original estimate of $ 5,600 proved to be too high, following receipt of pay slips confirming the actual earnings, arrears are payable based on annual rate of income of $3,780, provided:

- the pensioner has notified within 14 days of 8 — th May 2005

- notification is regarded as part of a departmental initiated review and not a PIR

Income of $800 per fortnight is to be reassessed via <">[glossary:PIPS:] using an effective date of 31 — st January 2005 and using income of $ 540 per fortnight. This will automatically calculate and pay arrears owing for the review period and $540 will be the income amount per fortnight, to be held until the earnings are next reviewed.

<">

Calculating Income – One-off Bonus

Last amended: 19 April 2011

How to calculate the annual rate of income for one off bonus

The amount of a one-off bonus received in addition to regular earnings is averaged over a 12 month period, from date received, as a separate item. In this way, the one-off payment can be taken into account whilst retaining the existing assessment of the ongoing regular rate of earnings.

One-off bonus payments received by pensioners subject to variable earnings assessment would normally be included in the earnings for the relevant review period. However, if the one-off payment is substantial enough that the pensioner is considered to have been obliged to notify of the payment as a separate event, then the one-off bonus can be assessed as an amount averaged over 12 months in addition to other variable earnings.

Example how to average one-off bonus over 12 months

The following is an example for how to assess income from a one-off, bonus. Notification is received that the pensioner has been paid a gross bonus of $2,000. To average the bonus, divide the gross amount of $2,000 by 26 (to obtain a fortnightly figure equal to the annual rate of income). Record the fortnightly figure in <">[glossary:PIPS:] under the [Earnings] option as a separate amount of $76.92 fortnightly earnings. In the field where the employer details are recorded, also record the word [bonus], to indicate that this is a separate amount. The bonus income is maintained for a period of 12 months, from the date of event, i.e. date bonus received.

Procedure Library – Date of Effect

Policy Library – Date of Effect

Policy Library –Annual Rate of Income & One-off Income

Notification of a one-off bonus

A person is expected to notify of receipt of a bonus within the usual notification period if this payment is in addition to their regular rate of earnings or exceptional in relation to their usual pattern of variable earnings.

Processing one-off bonus and earnings review

Processing of the notification may be held over until a variable earnings review becomes due when:

Procedure Library – When an event ends an established review period

- the notification coincided with the end of the review cycle of the person, or

- the amount of bonus did not impact significantly on the overall annual rate of income from earnings.

Recording income and reviews for one off bonus

To process a notification advising that a person has received a bonus payment from their employer, follow the next five steps.

|

Step |

Action |

|||

|

1 |

Apply the date of effect rules as for a notifiable event, except: More →

Procedure Library – When an event ends an established review period |

|||

|

If the receipt of the bonus... |

Then for date of effect purposes... |

|||

|

coincides with an earnings review period ending |

treat as if part of the earnings review |

|||

|

when taken into account does not impact significantly on the overall rate of income from earnings |

do not process as a notifiable event, and hold over until the earnings review becomes due and treat as if part of the review |

|||

|

Note: If processed as a notifiable event , PIPS will automatically calculate the date of effect of a variation, when the option [Notification Rules Apply] is selected and the date of event and date of notification are recorded in the worksheet. |

||||

|

2 |

Calculate the annual rate of income for the bonus using the following formula: $ A divided by 26 = $ B Note: Where A = gross bonus amount and B = fortnightly average (annual rate of income). |

|||

|

3 |

Record the amount B in PIPS [Earnings] folder, as a separate amount from other earnings which are recorded. |

|||

|

4 |

In the field called [Employer] record the word [bonus] to indicate that this amount is in respect of a bonus only. Finalise PIPS worksheet. |

|||

|

5 |

Set a review in DRS using review reason [Earnings] for 12 months, from date bonus is received. Note: For example, if the bonus was received on the 17/08//06, then income from the bonus is recorded in the pension assessment up to and including the 16/08/07 and the income is deleted from the 17/08/07. |

|||

|

6 |

When review becomes due, delete bonus income from pension assessment via PIPS. |

|||

<">

Calculating Income – One-off Earnings

Last amended: 19 April 2011

How to calculate the annual rate of income for one off earnings

The amount earned for a one off period of employment of 12 months duration or less is averaged over 12 months. Usually, one off employment is short term or seasonal in nature, eg fruit picker or a Santa Claus and does not last more than a few weeks or months. However, there may be instances of one-off employment, which last up to 12 months.

Example of one-off episode of employment lasting up to 12 months

An example of a person being regarded as undertaking one-off employment, where they may be employed for up to 12 months, is one contracted to deliver a service or product such as producing a book or painting a portrait. Payment for the contract may be made in full and up front, as periodic lump sums amounts or as a partial payment at the beginning and at the end of the contract. The person may take as long or as little time as they need, within a deadline and will be paid a fixed price for their service, rather than on an hourly rate. Even if they take up to (but not more than) 12 months to finalise the contract and provided employment is not likely to be repeated within the next 12 months, they may considered to be employed on a one-off basis.

Policy Library –Definition of annual rate of income

Policy Library –Single period or one-off income from employment

Example how to average one-off income over 12 months

The following is an example for how to assess income from a one-off, short-term contract. Notification is received that the pensioner has gained a contract for 3 months and at the completion of the contract will earn $3,000. To average the earnings, divide $3,000 by 26 (to obtain a fortnightly figure) and include the amount of $115.38 per fortnight in the pension assessment for a period of 12 months from the date of event, ie date earnings commenced.

Policy Library – Date of effect

Policy Library –Definition of annual rate of income

Policy Library –Single period or one-off income from employment

One-off employment recurs within 13 weeks of original assessment

When a second period of one-off employment recurs within 13 weeks of the first period of one-off employment, consider whether the person is really employed on a one-off basis, or whether earnings should be assessed as being variable.

Policy Library – Where one-off employment is repeated

Example one-off employment recurs within 13 weeks of original assessment

The following is an example for how to assess income from two periods of one-off employment, which commence within 13 weeks of one another:

- Period one commenced 15 — th March '04 - earned total of $1950 equals $75 per fortnight income

- Period two commenced 20 — th April '04 - earned total of $2340 equals $90 per fortnight income

Add two amounts together and reassess from 15 — th March '04 and income is held for 12 months until 14 — th March '05. The new rate applies from the original effective date and will result in an overpayment of pension. The retrospective reduction is allowed under <">section 56H VEA as the original statement regarding the earnings not being repeated within 12 months was false or misleading, even if the statement was not intentionally so.

One-off employment recurs more than 13 weeks from date of original assessment

When there is a gap of more than 13 weeks between the finish of one instance of one off employment and the commencement of a new period, these are assessed separately. This is regardless of the amounts earned in each period, that is, whether more or less income is earned from the first compared to the second instance of employment is not relevant.

Policy Library – Considerable time between one-off periods of employment

Example one-off employment recurs more than 13 weeks from date of original assessment

The following is an example for how to assess income from a second period of one-off employment which commences more than 13 weeks from the commencement of the first period:

- Period one 15 — th March 2004 - earned total of $1950 equals $75 per fortnight income

- Period two from 20 — th September 2004 - earned total of $2340 equals $90 per fortnight income

Assess $75 fortnightly income from 15 — th March 2004 and income is held until 14 — th March 2005. Assess $90 fortnightly income from 20 — th September 2004 and income is held for 12 months until 19 — th September 2005.

Recording income for multiple one off periods of employment

The following table describes the process of dealing with multiple periods of one-off income (gap >13 weeks).

|

Stage |

Description |

|

1 |

First notification received from pensioner to advise that employment commenced 15 — th March 2004. They advise at this time that this is a one-off contract and that do not expect to work again in the next 12 months and they will be paid $1,950 gross at the end of the contract. |

|

2 |

The income of $1,950 is averaged and assessed as income for the next 12 months at a rate of $75 per fortnight. (1,950 divide by 26 = 75). |

|

3 |

Review is set in <">[glossary:DRS:] for 15 — th March 2005 (12 months from date employment commenced) to delete income from first contract from pension assessment via <">[glossary:PIPS:]. |

|

4 |

Second PIR notification received from pensioner advising they have unexpectedly received a second contract commencing 20 — th September 2004 and to be paid a total of $2,340. The pensioner advises that they will not accept any more work at the end of this contract, as they are going on holidays. |

|

5 |

The income of $2,340 is averaged and assessed as income for the next 12 months from 20 — th September 2004 at a rate of $90 per fortnight, (2,340 divide by 26 = 90), in addition to the previous one-off earnings. |

|

6 |

Another review is set in DRS for 19 — th September 2005 (12 months from date employment commenced) to delete income from second contract from pension assessment. |

|

7 |

When the DRS review becomes due 19 — th September 2005, delete income from assessment via PIPS with an effective date of 20 — th September 2005. |

<">

Recording Employment Income - Work Bonus

Last amended: 5 September 2011

Recording of employment income in PIPS

Regardless of the Work Bonus, employment income should continue to be recorded in the PIPS Earnings screen at its gross value. PIPS will calculate any Work Bonus income concession applicable at the Calculate Pension stage of PIPS Worksheet processing. Any impact on the Work Bonus Bank will also be calculated and applied.

Whether a Work Bonus income concession applies will not be displayed in the PIPS Earnings screen itself. Any Work Bonus income concession calculated will be displayed in the Worksheet Summary of the PIPS Worksheet and should be checked before Authorisation of the PIPS Worksheet.

The calculation of the Work Bonus income concession and Work Bonus Bank accrual and depletion will be performed automatically by Batch and PIPS assessments and applied to income recorded in the PIPS Earnings screen. Therefore it is important that the income information accessed by these assessment processes is correctly recorded.

For the purposes of the correct application of the Work Bonus it is essential when recording employment income in the PIPS Earnings screen that :

- 'Owner' – employment income is attributed to the correct recipient of the income; and

- 'Employment income' – only income that meets the definition of employment income is recorded in the PIPS Earnings screen

Owner of employment income

The introduction of the Work Bonus means that greater care must be taken when recording and reviewing employment income to ensure that income is attributed to the correct “Owner”.

Correct assessment of the Work Bonus requires that a recipient of employment income must individually meet the eligibility criteria, such as age and receipt of a pension. Each member of a couple who individually meets the eligibility criteria will attract a Work Bonus concession on their respective income. This means that there can be up to two Work Bonus concessions in partnered assessments. Each individual will have their own Work Bonus Bank based on their own eligibility and employment income history.

PIPS now prevents the recording of employment income with a joint owner. Where a couple actually receive employment income jointly, the employment income should be halved and each person's half share recorded separately.

PIPS – Work Bonus

The Work Bonus Bank is displayed in PIPS in a screen situated directly below the Earnings screen. The Work Bonus Bank screen will include:

- Balance – as at the end of the day before the Effective Date of the Worksheet,

- Balance Adjustment – a field that allows a manual adjustment to be made to the balance if necessary,

- Adjustment Reason – to record the reason for any adjustment to the balance.

As with the Work Bonus income concession, changes to the accrual or depletion rate from the Work Bonus Bank arising out of changes made in the PIPS Worksheet will not display until Worksheet Summary and should be checked before authorising the PIPS Worksheet. Regardless of any changes made to Earnings in a PIPS Worksheet, the Work Bonus Bank balance displayed in the Work Bonus Bank folder will remain the balance as at the end of the day before the Effective Date of the Worksheet.

Adjustments may be made to the Work Bonus Bank Balance as at the Effective Date of the Worksheet if necessary by inserting a positive or negative adjustment figure in the Balance Adjustment field. When making an Adjustment to a Work Bonus Bank Balance a reason must be recorded in the Adjustment Reason field.

Adjustments to the Work Bonus Bank Balance should not be common and will only be necessary when the balance displayed as at the Effective Date of the Worksheet is incorrect. The most common reason for adjusting a Work Bonus Bank balance is likely to be to record balances previously accrued whilst in payment at Centrelink.

Display of the Work Bonus in VIEW

The Work Bonus income concession/s and Work Bonus Bank depletion/s applicable to a pension assessment will display as separate negative amounts in VIEW Pension Assessment and Pension Outcomes tabs in the Work Bonus folder. The Work Bonus income concession is shown under the heading Work Bonus Discount. Any depletion from the Work Bonus Bank is shown as Work Bonus Depletion.

The Work Bonus Bank folder in the Pension assessment tab provides a full history of the client's Work Bonus Bank and is independent of the date of the Pension Assessment being displayed on the tab. The “Current Work Bonus Bank Balance” displayed is today's balance, regardless of the date of the Pension Assessment.

The “Current Work Bonus Bank Balance” is also displayed in the Summary tab.

Veterans Vocational Rehabilitation Scheme

An invalidity service pensioner VVRS participant can be entitled to the work bonus concession if they meet the eligibility requirements for the work bonus and the work bonus income concession amount deduction from their gross income is greater than the VVRS excluded income amount.

Procedure Library – Veterans' Vocational Rehabilitation Scheme (VVRS)

<">

Partnered ISS Assessments with Employment Income

Last amended: 5 September 2011

What is the issue with partnered ISS assessments

Because the personal details of the partner of a war widow/er with ISS cannot be recorded in the war widow/er's ISS assessment, the Work Bonus may not be applied correctly where the partner of a war widow/er has employment income and the income is recorded in the PIPS earnings screen. Information regarding the correct owner of employment income and the date of birth of the partner is not available for assessment processes to check eligibility for the Work Bonus.

When is the partner of an ISS recipient eligible for the Work Bonus

The following outlines eligibility for the Work Bonus in regard to the employment income of the partner of a war widow/er receiving ISS.

If the partner of an ISS recipient with the employment income :

- does not receive SP, ISS or Centrelink payment – no work bonus applies;

- receives SP or ISS – the Work Bonus applies if the partner is qualifying age (veteran pension age);

- receives Centrelink payment – the Work Bonus applies if the partner is Social Security age pension age.

Recording employment income in ISS partnered assessments

Special care must be taken with partnered ISS assessments which involve employment income to ensure that the income is not recorded in a way that will incorrectly apply, or fail to apply, the Work Bonus. The following procedures apply when recording employment income in partnered ISS assessments :

|

1. If the recipient of the employment income is the war widow/er : |

|

|

2. If the recipient of the employment income is the partner of the war widow/er : |

|

|

Note: Prior to the introduction of the Work Bonus Bank, employment income of the partner of an ISS recipient could be recorded on the Earnings screen in cases where both the ISS recipient and their partner qualified for the Work Bonus and only the partner had employment income. Following the introduction of the Work Bonus Bank only employment income of the ISS recipient can be recorded in the Earnings screen to ensure that the ISS recipient's Work Bonus Bank is correctly calculated. |

|

If the partner of the ISS recipient is eligible for the Work Bonus:

|

Format for recording employment income in partnered ISS assessments

Employment income for partners of ISS recipients should be recorded in the PIPS Other Direct Income screen. Record in the following format, indicating that this is employment income or that the Work Bonus is applied.

Examples

- David Jones (Mr C D Smith – Employment)

- Dept of Education (Mr A E Jones – Work Bonus)

Where employment income of the ISS recipient is recorded in the Earnings screen, it should be made clear that the ISS recipient is the Owner.

Examples

- David Jones (Mrs I E Smith)

- Dept of Education (Mrs D C Jones)

Partnered ISS assessments and the Work Bonus Bank

Manual record of Work Bonus Bank

It is important to remember when dealing with the employment income of partners of ISS recipients that the Work Bonus Bank may apply. The Work Bonus Bank will not automatically be calculated or applied to the assessment of employment income in these cases. In all cases where a partner of an ISS recipient has employment income, and is eligible for the Work Bonus, their Work Bonus Bank will need to be maintained manually.

Employment income under $250.00 per fortnight

Where the employment income of the partner of an ISS recipient who is eligible for the Work Bonus is under $250.00 per fortnight, a record of accrual to the Work Bonus Bank must be maintained.

Employment income increasing to over $250.00 per fortnight

Where employment income of the partner of an ISS recipient who is eligible for the Work Bonus increases to over $250.00 per fortnight, their Work Bonus Bank Balance will need to be calculated based on previous accrual and depletion of the Bank from the time of the commencement or increase in employment income.

If the partner is entitled to disregarding of employment income over $250.00 per fortnight because of their Work Bonus Bank Balance, the adjustment to employment income must be applied manually and the depletion to the Work Bonus Bank Balance calculated manually.

Employment income commences at over $250.00 per fortnight

Where the partner of an ISS recipient commences to receive employment income at over $250.00 per fortnight, whether the partner has accrued a Work Bonus Bank Balance prior to commencing employment must be considered. The Work Bonus Bank Balance due to previous accrual will need to be manually calculated.

If the partner is entitled to disregarding of employment income over $250.00 per fortnight because of their Work Bonus Bank Balance, the adjustment to employment income must be applied manually and the depletion of the Work Bonus Bank calculated manually.

Partnered ISS assessments – maintaining the Work Bonus Bank

A spreadsheet has been created titled “Work Bonus Bank Calculator” that should be used to keep a record of the Work Bonus Bank for partners of ISS recipients.

Income Support – Work Bonus Bank Calculator

http://sharepoint/servingourcustomers/incomesupport/Documents/11135129E.tr5

A TRIM container has been created with the following details :

- 1103570 : BENEFITS – Eligibility Determination – Work Bonus Bank. This container should be used to store the manual Work Bonus Bank Calculator spreadsheets for ISS partners.

It will only be necessary to create a manual spreadsheet record of the Work Bonus Bank for ISS partners where the partner is eligible for the Work Bonus and has employment income. When an ISS partner who is eligible for the Work Bonus (ie paid a pension by Centrelink and over Social Security pension age) commences employment after 28 June 2011, their Work Bonus Bank Balance will need to be kept calculated up to the commencement of earnings and ongoing record kept.

The manual Work Bonus Bank spreadsheet must be updated every time the rate of Earnings changes, as this may affect the rate of accrual or depletion in the Work Bonus Bank.

Where the ISS partner is paid service pension or age pension by DVA, a correct record of the partner's Work Bonus Bank will be maintained by DVA systems under the person's own file number.

For all ISS partners, as the employment income must be recorded in the Other Direct Income screen in PIPS, the effect of the fortnightly Work Bonus discount and any depletion from the Work Bonus Bank must be manually calculated and applied to the rate of income assessed.

<">

Manual Rates Cases with Employment Income

Last amended: 5 September 2011

Work bonus and manual rates cases

For manual Method of Assessment cases, where a pensioner who receives employment income is eligible for the Work Bonus, the Work Bonus needs to be applied manually in the calculation of the pension rate payable. PIPS will not automatically apply either the fortnightly Work Bonus Discount or depletion from a Work Bonus Bank balance to the assessment of employment income. Any Work Bonus Discount, or Work Bonus Bank Depletion applicable needs to be applied manually in the pension calculation process. This means also that a Work Bonus Discount or Depletion will not display in the Pension Assessment in VIEW, even where it should be used to calculate pension rate.

Procedure Library – Reassessment at pensioner's or department's initiation

However, a Work Bonus Bank will be separately maintained for pensioners who are eligible for the Work Bonus and paid under a manual Method of Assessment.

Where a manual rates pensioner who receives employment income is eligible for the Work Bonus it is important that the gross rate of employment income is recorded in the Earnings screen. This will allow the correct accrual to the Work Bonus Bank to take effect where employment income is less than $250 per fortnight and any depletion from the Work Bonus Bank to be correctly maintained in the Work Bonus Bank record. Work Bonus discounts should be applied in the manual calculation of the pension rate, but the gross rate of employment income must be recorded in PIPS.

In summary, for manual rates cases with employment income you must:

- record the GROSS rate of employment income in the PIPS Earnings screen – even if deductions from employment income are being applied due to the Work Bonus

- manually deduct any fortnightly Work Bonus Discount from the employment income when calculating the pension rate

- manually deduct any Work Bonus Bank Depletion from the employment income when calculating pension rate

- check that the automatically maintained Work Bonus bank record is applying the correct accrual or depletion and matches the manual employment income and pension rate calculation.

Example 1 – Compensation case

Mr Jones is not paid service pension due to his MCRS incapacity compensation payments. Mrs Jones does receive service pension and also has employment income of $450.00 per fortnight. Mrs Jones' service pension is paid under Manual Rates to ensure correct application of the excess compensation after Mr Jones' pension is reduced to nil.

Mrs Jones is over qualifying age and is entitled to the Work Bonus. Her pension rate is calculated under the Non-transitional rules.

In manually calculating Mrs Jones' rate of service pension, the first $250.00 per fortnight of her employment income will be disregarded under the Work Bonus and only $200.00 per fortnight of employment income will be assessed.

However, her gross rate of employment income of $450.00 per fortnight must be recorded in the PIPS Earnings screen to ensure that there is no accrual to her Work Bonus Bank. (If the assessed income of $200.00 per fortnight is recorded in the Earnings screen, $50.00 per fortnight will accrue to the Work Bonus Bank in error.)

Example 2 – Transitional case

Mr Smith is receiving service pension under the Transitional rates. Because he was granted service pension after 20 September 2009 and was entitled to the Transitional assessment on transfer from Centrelink, Mr Smith's rate of pension is calculated using Manual Rates.

Mr Smith has employment income of $200.00 per fortnight and was over qualifying age of 60 on 28 June 2011 when the Work Bonus Bank was introduced.

Because Mr Smith is paid under the Transitional rates, the Work Bonus does not apply in the calculation of his rate of pension, and the gross rate of employment income is taken into account in calculating his rate of pension.

Mr Smith's gross rate of employment income of $200.00 per fortnight is recorded in the PIPS Earnings screen.

Although Mr Smith's pension is calculated under the Transitional rules, his Work Bonus Bank is still maintained to allow ongoing calculations under the Non-transitional rules. As Mr Smith's gross employment income is $200.00 per fortnight, $50.00 per fortnight will accrue to his Work Bonus Bank.

<">

Processing the Earnings Review

Last amended: 19 April 2011

How to decide how often to review earnings

Recipient Obligations

Section 54 VEA

Choose a length of time between reviews as prescribed in the <">Specific Review Guidelines, also consider the following:

- the consistency or fluctuation of hours worked and income earned

- the likelihood of a person failing to comply with their obligations, eg if they have a history of overpayments or failing to notify of changes in circumstances

- multiple employers or employment contracts

- convenience to the pensioner

- convenience to the department

Recording information on DRS – Review Details Screen

To assist with Quality Assurance checking and off file processing, for each earnings review set in <">[glossary:DRS:] record the following information in the free text field:

Departmental Review System – DRS User Guide

- details of earnings assessed as regular, variable or one-off

- dates of the current review where variable earnings

- dates of the next review where variable earnings

- how annual rate calculated

- details of evidence provided

- copy of the free text inserted into the <">[glossary:PIPS:] advice

Example of suggested free text for Review Details Screen in DRS

The following paragraph is an example of the information to record in the free text on the Review Details Screen in DRS:

- reviewed 1 — st Dec 04 to 28 — th Feb 05

- variable earnings - pay slips total = $2,095

- divide by 13 weeks x 2 = $322.30 p/f earnings

- next period 1 — st March 2005 to 31 — st May 2005'

- pensioner advised in latest <">[glossary:PIPS:] advice (insert copy of free text from PIPS advice)

Example of suggested wording for PIPS advices

The following paragraph is an example of how to advise a pensioner of the earnings assessed, their next review period and their obligations. It is intended as a guide to the content required in the advice:

'Your earnings have been assessed at $ 352.96 per fortnight, if this amount changes, please notify us no later than 14 days from the date of the change, or your pension may be overpaid or underpaid. Please confirm details of your earnings for the period from 1st March 2005 to 31st May 2005 by providing copies of your pay slips, within 14 days of 31st May 2005.'

Suggested calculation sheets

The following three checklists have been devised to assist in processing new claims and reviews with earnings income which is:

- regular

More →More → (go back)

Income Support – Specific Reviews Regular Earnings Calculation Sheet

- variable

More →More → (go back)

Income Support – Specific Reviews Variable Earnings Calculation Sheet

- one-off employment

More →More → (go back)

Income Support – Specific Reviews One-off Earnings Calculation Sheet

Earnings related letters available in DRS

All the letters in DRS are named and prefaced with the category of review type to which they are linked.

Departmental Review System – DRS User Guide

|

Name |

Description |

When to use |

|

Earnings Commenced – Pensioner |

Brief questionnaire seeks details and evidence of nature of employment, pay rates and date of commencement. |

Issued to pensioner upon receipt of PIR that they have commenced employment. |

|

Earnings Current – Employer |

Detailed questionnaire seeks evidence and information on allowances, nature of employment, pay rates, hours worked, Workers' Compensation claims, date of commencement/ termination and salary sacrifice. |

When annual review becomes due, or when notification received that employment has ceased, issue to employer to confirm details of current or former employment. |

|

Earnings Current Annual – Pensioner |

Brief questionnaire seeks details and evidence of earnings for previous and current financial years. |

When annual earnings review becomes due. |

|

Earnings Current Quarterly – Pensioner |

Questionnaire seeks details and evidence of earnings for the quarterly period covered by the earnings review. |

Issued to pensioner when the first review for a regular earnings review becomes due or for any quarterly review for a variable earnings review. |

|

Earnings Current Quarterly Abridged – Pensioner |

Brief questionnaire seeks details and evidence of earnings for the quarterly period covered by the earnings review. |

Issued to pensioner when the quarterly review for a variable earnings review becomes dues. |

|

Earnings Previous Years - Pensioner |

Questionnaire seeking details of annual income for a specified financial year/s and current employment, if applicable. |

Issued to pensioner to gather information, to identify if an overpayment may have occurred. |

<">

Date of Effect and Obligations for Earnings Reviews

Last amended: 19 April 2011

Regular earnings

Pensioners receiving regular earnings have an obligation to notify of any changes in their rate of regular earnings that may affect their pension rate.

Reductions of pension due to increases in regular earnings take effect from:

- the date of event where the increase in earnings is not notified within the notification period following the increase in earnings, or

- the day after the notification period where the increase in earnings is notified within the notification period.

Variable earnings

The following table is to assist in determining the date of effect to be used when updating variable earnings.

Policy Library – Date of effect

Policy Library – Specific and Compliance reviews

|

If the pension variation is ... |

and the pension variation is caused by ... |

then the date of effect of variation or termination of pensions is ... |

|

a reduction |

|

|

|

a reduction |

|

|

|

a reduction |

|

|

|

an increase |

|

|

|

an increase |

|

|

One-off earnings

Pensioners have an obligation to notify of any one-off earnings that may affect their pension rate within 14 days of the commencement of employment.

Reductions of pension due to commencement of one-off earnings take effect from:

- the date of event where the commencement of one-off earnings is not notified within the notification period, or

- the day after the notification period where the commencement of one-off earnings is notified within the notification period

One-off earnings amounts assessed over 12 months are always removed from the assessment on the anniversary of the date employment commenced. This means that where a pensioner complies with their obligation to notify of the commencement of one-off earnings within the notification period, one-off earnings are effectively assessed for only 25 fortnights. Where the pensioner fails to comply with their obligation to notify of the commencement of one-off earnings within the notification period, one-off earnings are assessed for 26 fortnights.

When an event ends an established review period

When a significant change in earnings occurs before the end of a variable earnings review period, this event will effectively end the current review period. If earnings remain variable, but with a different pattern, a new review period begins. If earnings have become regular, the ongoing earnings are assessed according to the procedures for regular earnings.

Policy Library – Obligations and date of effect

<">

Assessment of Income from Employment for Age Pension